The Federal Reserve Board's recent financial stability report neglected to mention the biggest risk facing the economy — inflation. With inflation now running at almost 7 percent, and with consumers expecting inflation to remain high next year, it can't be long before mortgage interest rates increase, and increase substantially. When that happens, home prices will fall and real estate sales will plummet because homes will no longer be affordable at current Fed-induced bubble prices. And history shows that, when the housing market tanks, the economy follows.

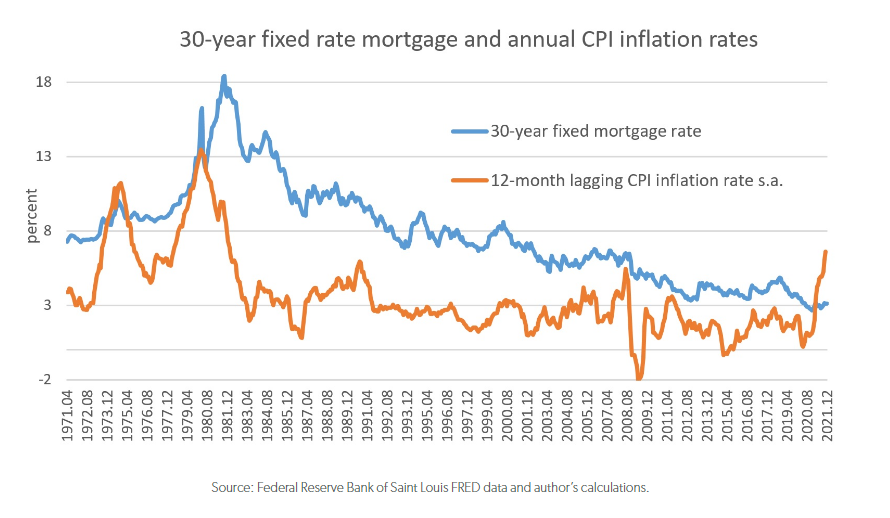

According to Bankrate, the national average rate on a 30-year fixed-rate mortgage the week of December 13 is 3.25 percent. At 6.8 percent, the current 12-month lagging CPI inflation rate is more than double the current mortgage rate, a phenomenon that has never happened in modern history. As the following chart shows, except for a brief period in the early 1970s, the interest rate on mortgages is always higher, and usually many percentage points higher, than the CPI inflation rate.

The last time the CPI inflation rate exceeded 6.5 percent, 30-year mortgage interest rates were more than 17 percent and housing markets were in freefall in the midst of a Federal Reserve-engineered recession initiated to tame inflation.

With mortgage rates at 3.25 percent, the monthly principal and interest payment on a $500k mortgage is $2176. Property taxes and insurance add additional monthly charges. Depending on where the home is located, taxes and insurance can add many hundreds or more dollars to the monthly mortgage payment.

If the mortgage rate doubles to 6.5 percent — which is still more than 0.25 percent less than the current inflation rate, monthly principal and interest payments on the $500K mortgage will increase to $3160. If the Fed stops QE purchases and normalizes interest rates to combat inflation, mortgage investors will likely require a mortgage yield higher than the inflation rate — something they have always done historically. Under that scenario, mortgage interest rates could jump to 8 percent or higher. If mortgage rates were to increase to 8 percent, a $500K mortgage would require monthly principal and interest payments of $3669, a monthly payment that is nearly 70 percent higher than currently required.

It does not take an economist to predict what will happen to home prices and the housing market if the monthly cost of servicing a mortgage increases by 70 percent. The monthly expense of home ownership is already out of reach for many households in America. If homes are no longer affordable at new higher mortgage rates, home prices will fall, and maybe fall substantially. A lot will depend on how quickly and successfully the Fed is at containing inflation and whether Congress passes the inflationary BuildBackBetter bill.

When mortgage rates do rise, it may take a while for home prices to adjust to the new reality. People will be reluctant to sell their homes at a real or perceived loss. Still, in my opinion, some sort of price correction seems inevitable. Please consult your own crystal ball before making any important financial decisions.

今年1月,新冠疫情突然而至。为了防止疫情扩散,我国采取了史无前例的交通阻断及人流限制措施,这也为我国农业农村经济发展带来了巨大挑战。

The Xinhua Institute, a think tank affiliated with Xinhua News Agency, on Friday issued a report in Kuala Lumpur, capital of Malaysia, titled "RCEP and the Vision of the Maritime Silk Road: New Frontiers for China-ASEAN Cooperation."

2025-04-14