Governments use corrective taxes to reduce the use of products that harm well-being and create costs not just to society at large (externalities) but also to individual consumers who may underestimate the future health consequences of their current consumption. Taxes on gas to reduce pollution or on carbon dioxide emissions to reduce greenhouse gases are classic examples of this approach. Nearly every public finance textbook includes a chapter on corrective taxes, and fiscal policy experts at the IMF and World Bank often advise countries to pursue these policies to ensure that prices more accurately reflect costs and generate significant revenues as well. But while raising carbon taxes to save the planet has, rightfully, garnered a lot of attention recently, corrective taxes on tobacco, alcohol, and sugar-sweetened beverage consumption—which also generates major negative social and self-imposed costs—are comparatively overlooked. As we show in a new paper, corrective taxes in 25 major economies fall far short of the huge negative externalities and self-imposed costs from tobacco, alcohol, and sugar-sweetened beverage consumption.

No major economy uses taxes to correct completely for the total productivity losses associated with alcohol, tobacco, and sugar-sweetened beverages

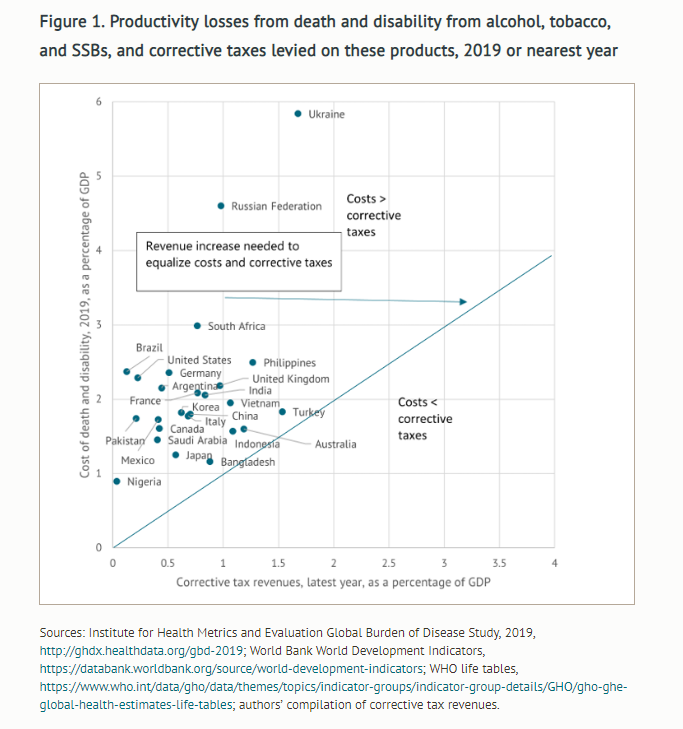

Using a sample of 25 large advanced and emerging markets accounting for three-quarters of global GDP, we show that about 60 million productive life years were lost every year in 2000, 2010, and 2019 from death and disability attributable to alcohol, tobacco, and sugar-sweetened beverage consumption. Using the cost-of-illness approach, the economic value of these lost productive life years is $2.1 trillion every year (in 2017 purchasing power parity dollars [PPP$]). This amounts to just under 2 percent of GDP in advanced economies and 2.3 percent of GDP in emerging markets, although a few countries are in the much higher 3 percent to 6 percent of GDP loss range (Russia, South Africa, and Ukraine). None of the 25 countries we studied have raised corrective taxes equivalent to the total productivity loss from alcohol, tobacco, and sugar-sweetened beverages (Figure 1).

There's significant scope for corrective taxes to help counter the costs from death and disability in both advanced and emerging economies

While it's clear that countries are paying a high toll for alcohol, tobacco, and sugar-sweetened beverages use, the challenge is for policymakers to recognize these costs and realign corrective taxes accordingly. On average, corrective taxes would need to triple from 0.7 percent to 2.1 percent of GDP to close the tax gap, and significantly more in countries with the largest gaps between productivity loss and corrective taxes.

For tobacco, we show that only 2 out of 25 countries collect corrective taxes in an amount equivalent to the tobacco-attributable death and disability productivity losses (Australia and Bangladesh), and that half of the overall corrective tax gap, or 0.7 percent of GDP, is linked to tobacco. The gap is significantly higher—by about another 0.4 percent of GDP—when tobacco-attributable medical costs are also taken into account. Higher taxes are correlated with greater declines in tobacco prevalence and are helping advanced countries to significantly reduce tobacco use.

Only one country raises corrective taxes on alcohol equivalent to or more than the relevant productivity loss (Turkey), and the tax shortfall is also 0.7 percent of GDP on average. However, the starting base for alcohol taxes is significantly lower than for tobacco taxes, so tax collections would need to be at least quadrupled to close the corrective tax gap, on average. If we were to take into account other externalities, such as crime and accidents, the corrective tax gap would be significantly larger. Again, the evidence suggests that greater effort in collecting corrective taxes is correlated with lower alcohol consumption.

Finally, we consider taxes on sugar-sweetened beverages as an illustration of using corrective taxes to incentivize healthier diets. In three out of the five countries that have both sugar-sweetened beverages taxes and data on revenue collections, we find that corrective taxes on sugar-sweetened beverages are more in line with productivity losses than is the case for taxes on tobacco or alcoholic beverages, suggesting that the calibration of these relatively new corrective taxes is broadly in line with the losses caused by the product. Taxes on sugar-sweetened beverages are likely to be most effective if set at relatively high rates (above 20 percent ad valorem equivalent) in countries with high consumption of these products (over 100 liters per person per year).

It's time for international financial institutions to step up their work on corrective taxes on alcohol, tobacco, and sugar-sweetened beverages

There's no doubt that the political economy of taxation can be fraught. Still, it's time for an increase in corrective taxes on alcohol, tobacco, and sugar-sweetened beverages to become a priority. Such taxes should be a routine part of the advice provided by international financial institutions to emerging markets and advanced economies with high rates of consumption. As we found in earlier work, the IMF and World Bank pay growing but still limited attention to these kinds of taxes in operations in fiscal policy. We urge more deliberate action in this direction.

今年1月,新冠疫情突然而至。为了防止疫情扩散,我国采取了史无前例的交通阻断及人流限制措施,这也为我国农业农村经济发展带来了巨大挑战。

A New Model for Human Advancement and Its Global Significance

2024-11-11