The COP26 negotiations over policies to combat the global problem of climate change have highlighted the great need for global cooperation toward a green transition. Indeed, the recently released Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC) delivers its starkest warning yet about climate change. The overarching takeaway from the climate accounting exercise is that limiting human-induced global warming requires limiting cumulative CO2 emissions to at least net zero by 2050. The Paris Agreement of 2015, with an ambitious target of keeping global warming below 1.5 degrees Celsius, has a conservative budget of 500 billion more metric tons of CO2 to be emitted to achieve the target. However, at the current rates of industrial emissions, it would take about 15 years to exhaust this budget. World leaders, including those from Africa, have a pressing task in reaching that goal. The burning question they face is: What is Africa's role and what are the policy priorities for accelerating Africa's green growth transition?

ENGAGEMENTS BASED ON COMMON BUT DIFFERENTIATED RESPONSIBILITY

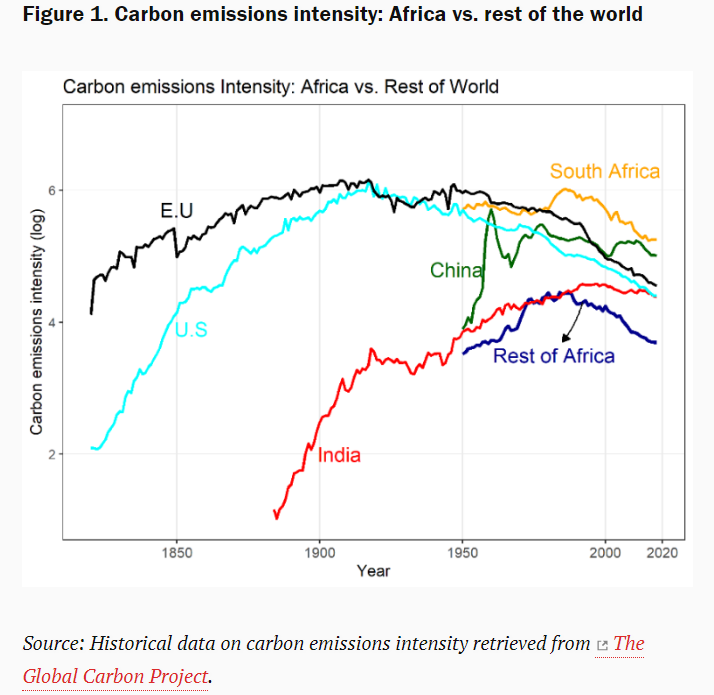

Given Africa's relatively low emissions intensity when compared with the rest of the world (Figure 1), some have argued from a climate justice perspective that Africa should not be involved with the cleaning-up process, but that rich countries responsible for over 2,400 billion tons of carbon dioxide emitted since the start of the industrial revolution should be fully responsible for cleaning up the mess. The problem, however, is that because Africa faces a disproportionate burden from the repercussions of climate change, it is in its best interest to actively engage with world leaders on the subject. Africa's position in the climate discussions should, nevertheless, be based on the principle of common but differentiated responsibility that delivers a win-win for the developing and developed worlds. Africa's engagement should be founded on a collaborative strategy that involves rich countries providing the enabling technology and financing (not just assurances) for the emerging world to transition to a green and sustainable economy in a manner that preserves progress on the much-needed growth in low-income countries.

DISMANTLING BOTTLENECKS TO A GREEN ECONOMY TRANSITION

Locally, policymakers need to dismantle two main obstacles to accelerate Africa's green economy transition. First, governments must trim down and, in many cases, discontinue widespread energy subsidies on fossil fuels. The average subsidization rate in Africa is about 33 percent, with the cost of fossil fuel subsidies representing an average of 3.8 percent of GDP, getting as high as 5.8 percent in Algeria. When energy subsidies are inefficiently applied, they fundamentally encourage excessive energy consumption through distorted lower prices that work to disincentivize investments in efficient and cleaner energy sources. According to the International Energy Agency's energy subsidy tracker, global fossil-fuel subsidy outlays reached a 14-year low in 2020 at $180 billion globally and $27.7 billion for Africa. Policymakers should seize the opportunity of this lower trend in subsidy spending occasioned by COVID-19 disruptions to naturally phase out inefficient energy subsidies and rechannel, in a carefully targeted manner, the freed-up resources to protect the poor and most vulnerable in society.

Globally, it is time for policymakers in advanced economies to make coal history. Although in America and Europe the consumption of coal has fallen by 34 percent since 2009, it still accounts for 27 percent of raw energy used and contributes a staggering 39 percent to annual emissions of CO2 from fossil fuels globally. If targets are to be achieved, the West should drastically reduce its use of coal; opening new coal plants (e.g., one recently in Germany) does not send a credible signal about the West's commitments.

Second, green energy investments in Africa, especially in renewable energy, need scaling up as current levels are running far below what is required to accelerate Africa's green growth transition. The U.N. estimates the annual investment gap for renewable energy infrastructure to be between $380 billion and $680 billion. Although investments in renewable energy have grown constantly over the past 10 years, this growth has mostly been concentrated in developed and transition economies, where most of the 63,388 greenfield renewable energy projects are located. The impact of COVID-19 also disproportionately affected the value and number of renewable energy projects, dropping by 37 percent in the least developed countries compared with 11 percent in transition economies.

Despite the COVID-19 impacts, renewable energy financing and investments are in a virtuous circle of falling costs, expanding deployment and accelerating technological progress. Solar panel equipment prices, for example, have fallen by about 80 percent since 2010, while wind turbine prices have fallen by 30 to 40 percent in the same period (see IREA). At the same time, a mismatch in the supply and demand for critical minerals for key clean energy technologies—cobalt, lithium, nickel, copper—presents a business case for Africa's engagement. The demand for lithium is expected to grow over 30 times by 2040 but supply from existing mines and projects under construction can only meet about half the projected demand. To address these supply chain bottlenecks, governments must lay out their long-term commitments for emission reductions/clean energy, which would provide the confidence needed for suppliers to invest in and expand mineral production. Clear commitments are important because, unlike the variety of fossil fuels that are produced in many countries, the mining of clean energy minerals is concentrated in a few countries. The Democratic Republic of the Congo, for example, produced about 70 percent of the world's cobalt in 2019.

Africa needs to ride these virtuous circles. Policymakers should tap into the growing market for green, social and sustainable (GSS) bonds to finance the green economy transition. The GSS bond market is estimated to have grown by over 300 percent in 2020, reaching a record high of between $425 billion (Moody’s) to $500 billion (S&P) by end of 2020. Surprisingly, out of the 16 countries that had issued green bonds as of July 2021, only four of them were outside Europe and only one was from Africa—Nigeria. Many more countries in Africa need to take advantage of this easy global financing environment to fund their larger renewable energy projects (priced at, or below, market risk). Policymakers can also attract green energy financing by using more direct policies such as the one recently introduced in Burkina Faso, with a new investment code that lowers the performance obligations for investors in green and renewable energy sectors.

MOVING FROM AGREEMENTS TO FULFILMENTS

As COP26 concludes, policymakers should remember to go beyond signing agreements on targets for net-zero carbon emissions to fulfilling those agreements through concrete financial and technological investments. For the developed world, a global, market-based carbon pricing regime should be the immediate priority. Operationalizing it would require setting a carbon price anchor (floor) for key large-emitting countries and adjusting it pragmatically to accommodate other countries based on equity consideration, historical emissions, and development levels. This strategy could be supplemented with green subsidies and other micro-regulations to direct financing to and incentivize innovation in low-carbon technologies. For the developing world and Africa, attracting green investments, leveraging green bonds, and phasing out inefficient and wasteful fossil fuel subsidies should be the immediate priorities for a green growth transition.

It is now time for all to stop talking the talk and start walking the walk.

今年1月,新冠疫情突然而至。为了防止疫情扩散,我国采取了史无前例的交通阻断及人流限制措施,这也为我国农业农村经济发展带来了巨大挑战。

A New Model for Human Advancement and Its Global Significance

2024-11-11