In 2019, Germany ran a current account surplus of $290 billion, the largest in the world. Germany's current account surplus is persistently large: from 2011 to 2020, it never dropped below 6% of GDP and remained above 7% for six consecutive years (from 2014 to 2019, see Figure 1). Such levels are highly unusual for a country in the western world as was pointed out back in 2018.

As a consequence, Germany's international investment position (the difference between the external financial assets and liabilities of residents of a given country) has consistently increased over the same period, reaching €2.1 trillion in the second quarter of 2021 or 61% of GDP.

Much of the current account increase is due to the corporate sector

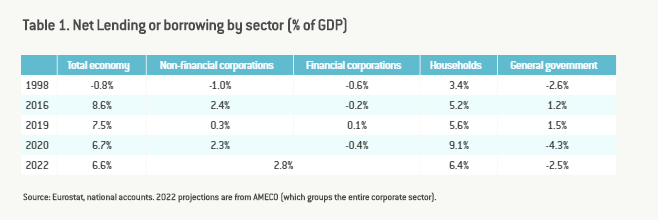

Looking at a sector-level breakdown of the economy-wide net lending position (Table 1) provides information on the sectoral composition of the increase in the current account balance. From 1998 to 2016 (the year with the largest current account surplus position as a % of GDP), the economy's total net lending position (as a % of GDP) increased by 9.4 percentage points. The increase in this period was due to increases in the non-financial corporate sector (+ 3.4 pp) and general government (+3.8 pp) and to a lesser extent households' net lending position (+1.8 pp). This somewhat contradicts the often-stated claims that Germany's current account surplus has been driven by thrifty households. The increase in the corporate sector is particularly unusual, resulting in it becoming a net-provider of funds to the economy (companies are usually net borrowers).

The increase in the corporate net lending is a result of both, an increase in corporate savings (Jüppner (2021)[1]) and a decrease in investments.

Between 2016 and 2019, the unusual situation of having a strong net-lending corporate sector changed notably, with the net lending position of non-financial corporations falling from 2.4 to 0.3% of GDP due in part to a pickup of investment in the manufacturing sector and a fall in the sector's net savings.

The pandemic had a negative impact on corporate investment and household borrowing. This resulted in a sharp increase in the net lending position of both non-financial corporations (+2pp) and households (+3.5pp). Conversely, the net lending position of the General government decreased by 5.8 pp in a single year. In other words, government measures were strong enough to more than offset the increase in net lending of the private sector, resulting in a slight decrease in the total economy's net lending position (-0.8pp).

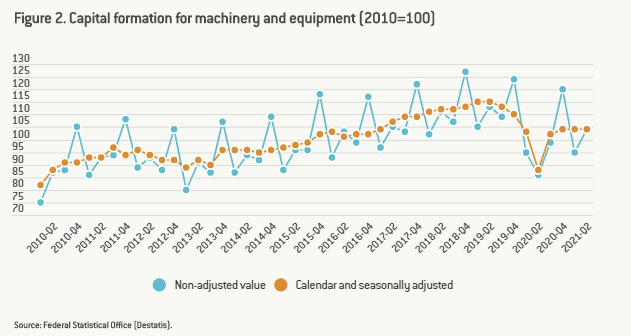

What is more surprising is that, according to AMECO forecasts, the net lending position of the corporate sector is set to remain very high in 2022, hinting that the unusual situation of net lending companies in 2016 could, in fact, be the new norm in the German economy. Could this indicate that the 2016-2019 pickup in corporate fixed capital formation was only temporary? Notably, preliminary numbers from the Federal Statistical Office indicate that capital formation for machinery and equipment in the entire economy during the first two quarters of 2021 remains below pre-pandemic levels (Figure 2).

An overall lack in investment

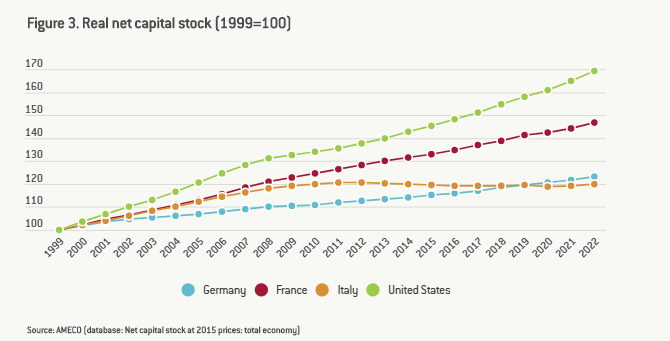

The overall low level of investment by the corporate sector in Germany has already been the subject of a previous blog post. The growth of the real net capital stock since the beginning of European monetary union in 1999 has been very slow in Germany (23%) compared to the United States (69%) or France (47%). Over the past couple of years, nothing indicates Germany is catching up with the growth rates of peers (Figure 3).

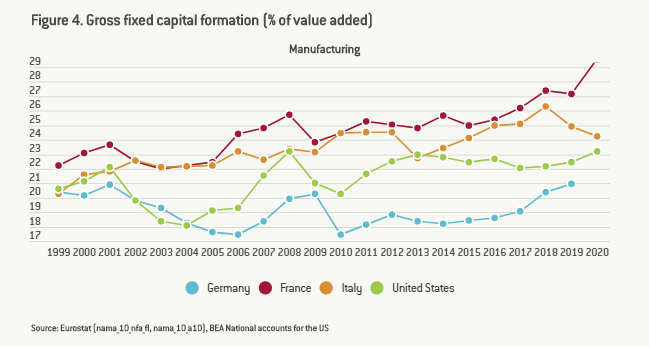

For example, in the manufacturing sector, Germany has been investing significantly less (as a share of value added) than France, Italy or the United States throughout most of monetary union (Figure 4). Despite a notable increase in the years leading up to the pandemic (2.4pp between 2016 and 2019), post-pandemic numbers and forecasts mentioned above suggest that such an increase may only have been transitory. Meanwhile, investments in the services sector have remained flat in recent years.

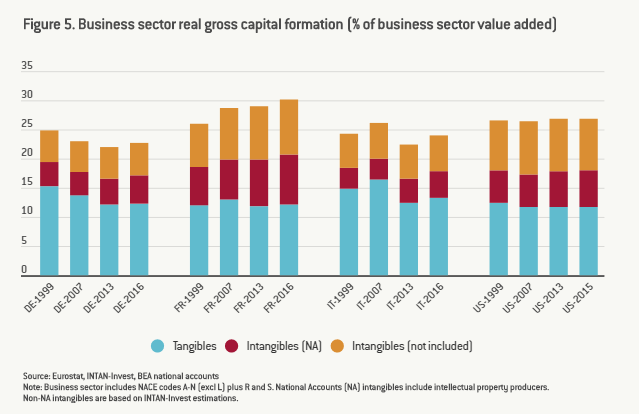

When breaking the numbers down by type of investment, investment in intangible capital has been significantly weaker in Germany than in France or the US and slightly lower than in Italy. Despite a very slight increase between 2013 (9.9% of value added) and 2016 (10.3%), investment in intangible capital does not seem to be picking up.

Conclusions

As talks to form a "traffic light" coalition continue, it is crucial that policy makers do not lose sight of the critical importance of private sector investment to the German economy. An important reason for the high and often criticised current account surplus is insufficient corporate investments. As employment grew substantially, capital investments did not keep up leading to a stagnating capital-labour ratio. The relatively muted wage developments in Germany compared with peers may partly reflect lack of investment dynamics, which ceteris paribus should raise labour productivity.

The incoming German government should reflect on how it can ensure increasing investments, especially in the corporate sector. Measures to incentivise investments in intangible capital should be considered. The incoming German government thus has an opportunity to trigger a virtuous cycle between increasing investments, higher minimum wages, lower corporate net lending and eventually a falling current account surplus. That virtuous cycle could be triggered by a combination of improving investment conditions and modernising the German infrastructure on the one hand and higher minimum wages on the other.

今年1月,新冠疫情突然而至。为了防止疫情扩散,我国采取了史无前例的交通阻断及人流限制措施,这也为我国农业农村经济发展带来了巨大挑战。